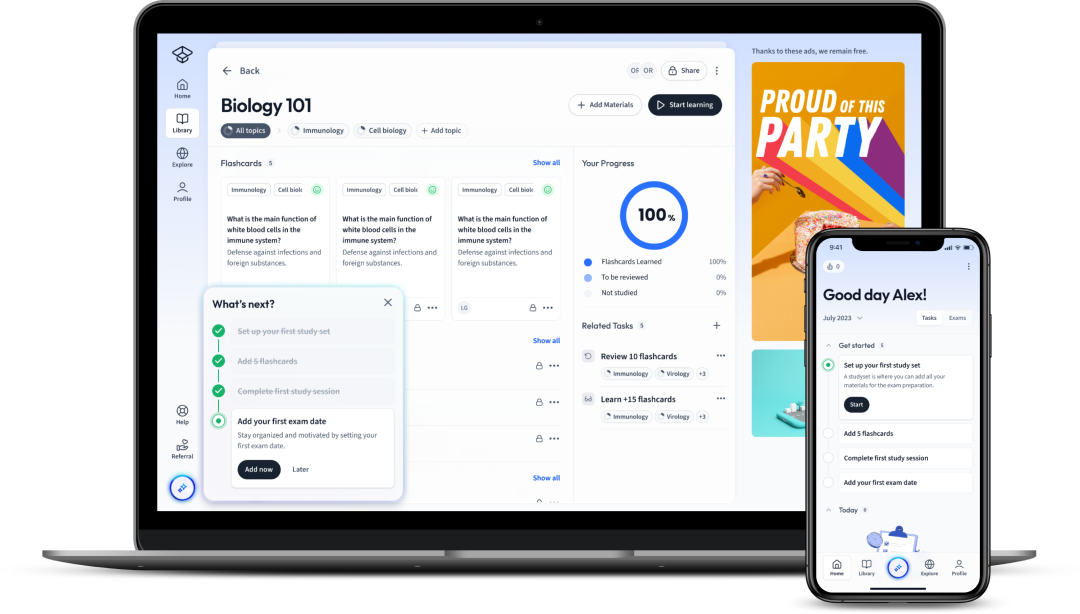

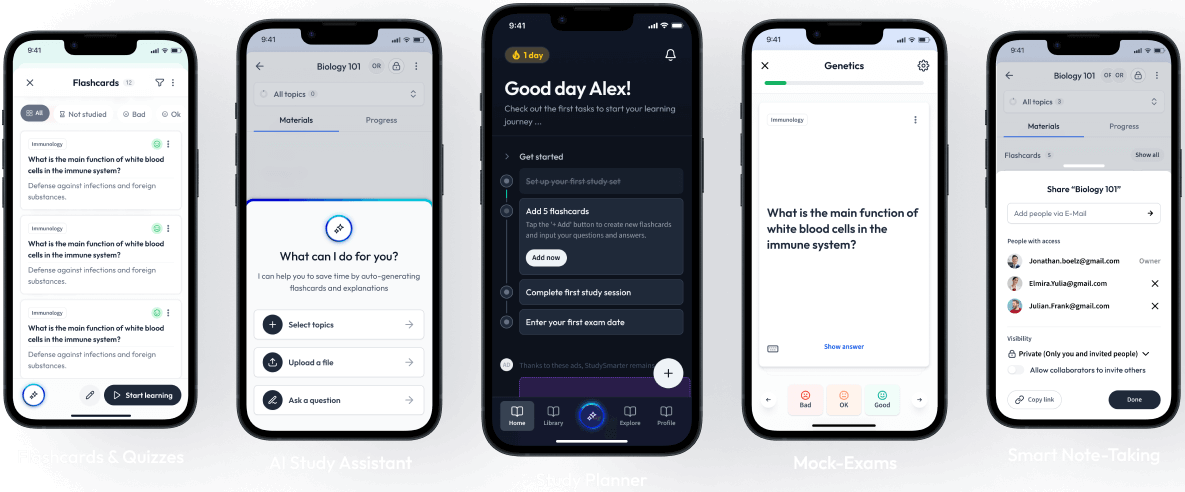

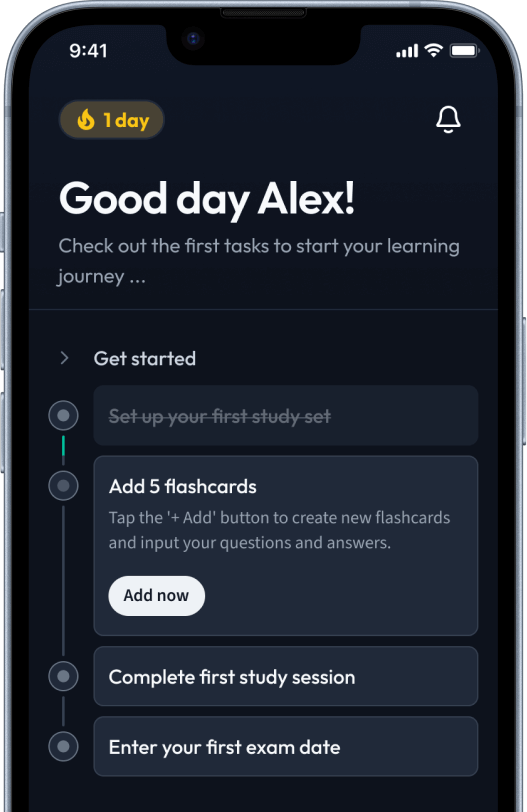

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Delve into the intriguing realm of managerial economics, a discipline addressing decision-making strategies within organisations. This comprehensive guide allows you to explore the definition and key components of managerial economics, understanding its significance and field of study. You can learn about the intersection of managerial economics and business strategy, appreciating how it shapes organisational architecture. Relevant techniques within the managerial economics landscape will be discussed, followed by practical examples and case studies, permitting a holistic grasp of this pivotal aspect of business studies.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDelve into the intriguing realm of managerial economics, a discipline addressing decision-making strategies within organisations. This comprehensive guide allows you to explore the definition and key components of managerial economics, understanding its significance and field of study. You can learn about the intersection of managerial economics and business strategy, appreciating how it shapes organisational architecture. Relevant techniques within the managerial economics landscape will be discussed, followed by practical examples and case studies, permitting a holistic grasp of this pivotal aspect of business studies.

In the realm of business studies, Managerial Economics takes precedence as a branch of economics that comprises studies and applications of relevant economic concepts and essential analytical tools for making sound and effective business decisions. It empowers managers with the knowledge needed to make efficient and sustainable decisions regarding the allocation of resources, production, pricing and much more.

Managerial Economics is invaluable to any business operation, large or small. Its principles lead to strategic decision-making that drives growth, stability and overall business success.

For instance, the principles of Managerial Economics may influence a strategic decision regarding whether a company should invest in expanding production or focus on improving existing infrastructure. The result could significantly impact the company's overall performance and sustainability.

| Application Areas | Example |

| Profit Maximisation | Choosing optimal levels of inputs to maximise profits |

| Risk Management | Deciding on insurance coverage to minimise risks |

| Strategic Planning | Forecasting market trends for future planning |

Studying Managerial Economics offers you a balanced blend of theoretical understanding and practical applications. Here are some of the key reasons why it is an essential area of study in Business Studies:

Theoretical Significance: Managerial Economics presents a structured approach to decision-making by blending economic theory and management practices. Theories such as Demand and Supply, Cost and Production, and Market Structure are aligned with practical business scenarios for better understanding.

Practical Importance: Managerial Economics equips professionals with analytical tools to improve decision-making and problem-solving efficiency. Skill sets like demand forecasting, cost analysis and profit management provide an edge in business operations.

Suppose a firm plans to start a new product line. Using Managerial Economics principles, the firm can make better investment decisions, forecast potential demand and decide on suitable pricing strategies for the new product line.

The interplay of Managerial Economics and business strategy is intricate and influential in the success of any business operation. It demonstrates how economic analysis can scale up through the application of key strategic decisions, leading to competitive advantage and sustainable growth.

Managerial Economics plays a pivotal role in crafting business strategies. Its fundamentals facilitate better decision-making, which, in turn, directly influences strategic planning and implementation.

Decision Making: Managerial Economics provides a sound foundation for making critical decisions. Its concepts, such as cost analysis and demand forecasting, are instrumental in arriving at decisions that match organisational goals.

For example:

A company planning to launch a new product can use the principles of Managerial Economics to understand market demand, set a competitive price, and make informed decisions on production scale and marketing strategies.

Strategy Formulation: In the competitive business environment, sound strategic planning is a must. Managerial Economics contributes effectively by providing vital insights into market trends, customer preferences, and competitor benchmarking.

In terms of Market Structures, for example, whether in a monopoly or in perfect competition, Managerial Economics leverages understanding of each structure's characteristics to guide strategic direction.

In a monopolistic market, a firm can apply pricing strategies that maximise profits due to the absence of competitors. In contrast, in a perfectly competitive market, the firm would need to focus on incremental innovations or cost optimisations to gain an edge.

Managerial Economics is strategically applied in various facets of business operations to optimise resource allocation, enhance customer satisfaction and maximise operational efficiency.

Demand Analysis: Demand is a fundamental concept in economics, and through strategic analysis, businesses can predict customer behaviour, plan production and manage inventory more efficiently.

A sudden surge in demand for a product can prompt a business to increase production levels, reduce price to harness the market or tailor marketing strategies to further fuel demand.

Pricing Strategy: Managerial Economics helps businesses establish strategic pricing by understanding the elasticity of demand, cost of production, and competitor pricing. It guides firms towards pricing decisions that maximise profits while ensuring customer satisfaction.

Consider a luxury watchmaker. By understanding that their customers are less price-sensitive (inelastic demand), they can set higher prices to maximise profits, while still maintaining customer loyalty.

Furthermore, when it comes to capital and profit management, Managerial Economics provides assistance in financial planning and forecasting, investment decisions, calculating optimal risk-return trade-offs, and determining a firm's profit-maximising level of output and price.

Let's take an illustration of capital allocation. If a firm is considering investing in technological upgrades versus expanding into a new market, Managerial Economics could aid in evaluating which option would bring higher future value and ultimately make the right investment choice.

In essence, the strategic application of Managerial Economics not only streamlines business processes but also enhances the overall decision-making quality, leading to business sustainability and growth.

A comprehensive understanding of Managerial Economics can significantly enhance the structuring of Organisational Architecture. Integrating economic theories, concepts and methods within the fabric of office layouts, roles, hierarchies, and systems enhances efficiency and productivity, resulting in greater business success.

Organisational architecture is the structured layout of the company's internal work processes, roles and relationships, hierarchies and responsibilities. Contextually, Managerial Economics offers insights and tools that can streamline the design and enhance the operational efficiency of an organisation.

Some of the key areas where Managerial Economics integrates with Organisational Architecture are as follows:

Operational Efficiency: In context of Organisational Architecture, incorporating analytical tools from Managerial Economics equips firms with the needed comprehension to streamline processes, optimise time management, and execute projects within deadlines.

A manufacturing company may apply economic models to understand the most efficient way to use limited resources, for example, raw materials, labour hours and machinery, to optimise production and minimise cost.

Goal Setting & Decision Making: Managerial Economics thus plays a crucial role in setting quantifiable, realistic, time-framed goals and aids in making strategic decisions that align with the long-term objectives of the organisation.

A firm, for example, might set a goal to improve its profit margin by 25% in the next fiscal year. Managerial Economics helps in identifying strategies, like cost reduction or increasing product prices, to achieve this goal. It also aids in decision-making on whether to invest in new technologies or diversify into new markets.

Employee Incentives: Understanding the economic principle of incentives, organisations can strategically design and implement reward systems. Incentives may include bonuses, commissions, promotions, or benefits and are often aligned with the firm's targets.

For instance, a sales team might be incentivised by an attractive commission structure that rewards high performers. If the team hits their sales target, members receive a certain percentage of the sales they generate as a bonus. This aligns the interests of the sales team (earning higher income and the organisation (increasing sales).

Organisational Design includes the elements that shape an organisation's structure and processes like hierarchy, roles and responsibilities, communication systems and more. Managerial Economics impacts Organisational Design in critical ways:

Hierarchy and Decision-Making Flow: Managerial economics can influence how hierarchies are structured within an organisation. Understanding economic principles can help companies design hierarchies that speed up decision-making and promote efficiency.

A company might use economic principles to design a flatter organisational structure. In this structure, decision-making authority is more dispersed, generally leading to quicker decisions and more employee empowerment.

Role Design & Division of Responsibilities: Managerial Economics provides a framework to design individual roles and distribute responsibilities efficiently. It helps to identify gaps, reduce role overlaps, and ensure tasks are divided effectively.

A firm might use principles of Managerial Economics to identify overlaps in roles. Once identified, tasks could be restructured such that each employee has a distinct set of responsibilities, increasing efficiency and reducing redundancy.

Policy Formulation: Managerial Economics plays an important role in policy formulation. By integrating economic principles into policy-making, firms can make sound financial and operational decisions.

Given the goal of sustainability, a firm might use principles of Managerial Economics to formulate energy-saving policies. Using less electricity, for instance, not only reduces utility costs but also helps protect the environment.

To sum up, the influence of Managerial Economics permeates various levels of organisation’s architecture and design. These impacts can transform the structure, communication channels, responsibilities, and decision-making mechanisms within an organisation to make it more efficient, effective, and poised for growth.

Delving into the sphere of business studies, at the heart of it lies the dynamic field of Managerial Economics. It provides a myriad of techniques to aid managers in strategic decision-making, ensuring effective and sustainable management of resources, and to evaluate the implications of different business strategies. These fundamental techniques directly contribute to the formulation of strategic decisions, leading to competitive advantage and sustainable growth.

Several methods or techniques under Managerial Economics are utilised by managers to make strategic decisions. These techniques help businesses maximise their profits while efficiently using available resources. To comprehend these techniques better, let's delve deeper:

Marginal Analysis: The marginal cost is the cost of producing one additional unit of output. Likewise, the marginal revenue is the additional revenue generated from selling one extra unit. By equating marginal cost to marginal revenue, businesses can optimise their production level for maximum profit. In LaTeX, this is represented as: \( MC = MR \)

Regression Analysis: The technique estimates the relationship between a dependent variable and one or more independent variables. For example, sales (dependent) might be related to factors like price, advertising expenditure, and competitors' prices (independents). The basic equation for simple linear regression is: \( Y = a + bX + e \), where \( Y \) is the dependent variable, \( X \) the independent variable, \( a \) is the intercept, \( b \) the slope and \( e \) is the error term.

Game Theory: Using mathematical models, game theory presents strategic scenarios and their potential outcomes. It helps predicting how competitors will react to strategic moves and how conflicts can be resolved.

Optimisation Techniques: Optimisation aims at making the best or most effective use of a situation, product, or resource within constraints. For instance, linear programming is an optimisation technique used to maximise output, given certain constraints like cost, labour, and material availability. Its basic mathematical representation is: \( Max Z = c1x1 + c2x2 \), subject to constraints \( a1x1 + a2x2 ≤ b \).

Managerial Economics techniques are widely utilised in decision making, offering valuable insights that drive strategic planning. They provide a structured approach to solve the complex problems that managers face in the actual business environment.

Marginal Analysis is a pivotal technique that guides the decision-making process. It enables the understanding of how much extra goods to produce or to what extent resources should be used. By equating marginal cost and marginal revenue, managers can decide the optimal level of output that maximises profit.

For instance, Marginal Analysis plays a crucial role in determining whether to shut down a factory. If the marginal cost of running the factory exceeds the marginal revenue, then it is economically sensible to close down the factory. On the other hand, if marginal revenue exceeds marginal cost, then production should continue.

Regression Analysis is another technique that aids in the decision-making process by estimating the quantitative relationship between variables. This can be used to predict future trends, enabling managers to make data-driven decisions.

For instance, a bookshop owner might use regression analysis to determine the impact of advertising expenditure on sales. If the analysis reveals a strong positive relationship, the owner might decide to increase the advertising budget to generate higher sales.

The Game Theory technique is instrumental for strategic decision making, particularly in a competitive business landscape. It provides insights into the potential actions and reactions of competitors, aiding businesses in designing robust competitive strategies.

For example, consider two competing firms in an oligopoly market considering launching a similar product. Game theory may help each firm predict whether the other will launch or hold the product, determine the payoff of each possible outcome, and thereby aid in making the optimal decision.

Optimisation Techniques play a critical role in managerial decision making, particularly when there are multiple objectives to be achieved with limited resources. Linear Programming, an optimisation technique, enables businesses to make decisions that maximise output or minimise costs, subject to constraints.

Imagine a furniture manufacturer that produces chairs and tables. The manufacturer has a fixed amount of wood and labour hours. Using linear programming, the manufacturer can determine the optimal number of chairs and tables to produce in order to maximise profit, subject to these constraints.

As evident, these Managerial Economics techniques equip managers with versatile tools to make data-driven, strategic decisions that accentuate the efficiency and profitability of business operations. Understanding and effectively utilising these techniques is, therefore, fundamental to proficient management and sustainable business growth.

Managerial Economics isn't just a theoretical concept addressed in lecture halls or business study textbooks. It’s an integral facet of actual business practices, influencing strategic decisions across small businesses, corporate giants, and everything in between. By delving into practical examples and case studies, you can better understand its implementation and appreciate its significance in real-world situations.

In the actual business world, Managerial Economics influences myriad decisions made on a day-to-day basis. Here are a few practical, real-life examples of Managerial Economics in action:

Consider the case of a renowned fast-food chain like McDonald's. To determine its product prices, McDonald's heavily relies on the principle of elasticity of demand, a core concept in Managerial Economics. The price for a popular item like the Big Mac is established considering its demand elasticity. By understanding that consumers are comparatively less price-sensitive (inelastic demand) towards such popular items, McDonald's can set a higher price, maximising profits while still maintaining customer loyalty.

Another example can be drawn from the manufacturing sector. Suppose a factory produces both eco-friendly bags and traditional plastic bags. The forecast predicts a swell in demand for eco-friendly bags due to increased environmental awareness among consumers. Using Managerial Economics principles like Demand Forecasting, the factory can ramp up the production of eco-friendly bags while reducing that of plastic ones in response to consumer demand trends.

Managerial Economics principles also extend their influence to the tech industry. Let's consider the example of Netflix, the streaming giant. According to various estimation models and analysis of viewer preferences, Netflix decides how much to invest in original content. This critical decision, influenced by Managerial Economics, enables Netflix to effectively allocate resources, creating content that captivates viewers and enhances subscription growth.

Now that we have understood some of real-life examples, let's take a more in-depth look into specific case studies depicting the application of Managerial Economics principles in the corporate world.

Airbnb & Dynamic Pricing: Airbnb, the world-wide online platform for lodging and tourism experiences is a solid example of Managerial Economics at work. One key aspect of Airbnb's business model is its dynamic pricing system. Prices for listed homes or experiences vary based on various factors including location, time of booking, day of the week, amenities provided, and more. This pricing strategy stems from the notion of price discrimination, enabling Airbnb hosts to maximise their profits by charging varying prices depending on demand conditions.

Uber’s Surge Pricing: Uber, the ride-hailing giant, utilizes principles of Managerial Economics in its surge pricing model. It's a prime example of dynamic pricing, where fares increase during periods of high demand or limited supply of drivers. The underlying principle here is the law of supply and demand. By increasing prices, Uber can balance the demand-supply equilibrium ensuring availability of drives when passengers need them most.

Apple’s Product Differentiation Strategy: Apple Inc., one of the most iconic tech companies worldwide, leverages Managerial Economics through its product differentiation strategy. Despite the substantially higher prices compared to its competitors, Apple enjoys a loyal customer base. This can be attributed to the fact that Apple has successfully differentiated its products in terms of design, quality, and user experience. This strategy, rooted in Managerial Economics, allows Apple to maintain strong sales and high profit margins in the competitive tech market.

These case studies provide insightful glimpses into how businesses apply Managerial Economics principles in their strategic decision-making, showcasing the practical applicability and significance of Managerial Economics in real-world business scenarios.

Flashcards in Managerial Economics1184

Start learningWhat is the Time Value of Money (TVM) in managerial economics?

The Time Value of Money (TVM) proposes that money available now is worth more than the same amount in the future, due to its potential to earn interest or make profitable investments.

What does TVM refer to essentially?

The Time Value of Money essentially refers to the principle that money can earn more money over time through interest and investment returns.

What does the Time Value of Money signify?

The Time Value of Money signifies that a certain amount of money today is greater than the same amount in the future due to its earning potential in the form of interest or returns.

What does \( PV \) stand for in the TVM formula?

In the Time Value of Money formula, \( PV \) stands for the present value or the sum you have today.

What does the Time Value of Money (TVM) allow us to compare?

The Time Value of Money (TVM) allows us to compare the worth of an amount of money today to its worth in the future.

How is the Time Value of Money (TVM) utilized in a business context?

In business, the Time Value of Money (TVM) is used to make capital budgeting decisions, calculate the net present value (NPV) of projects, determine pension funds' liabilities and value complicated financial derivatives.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in