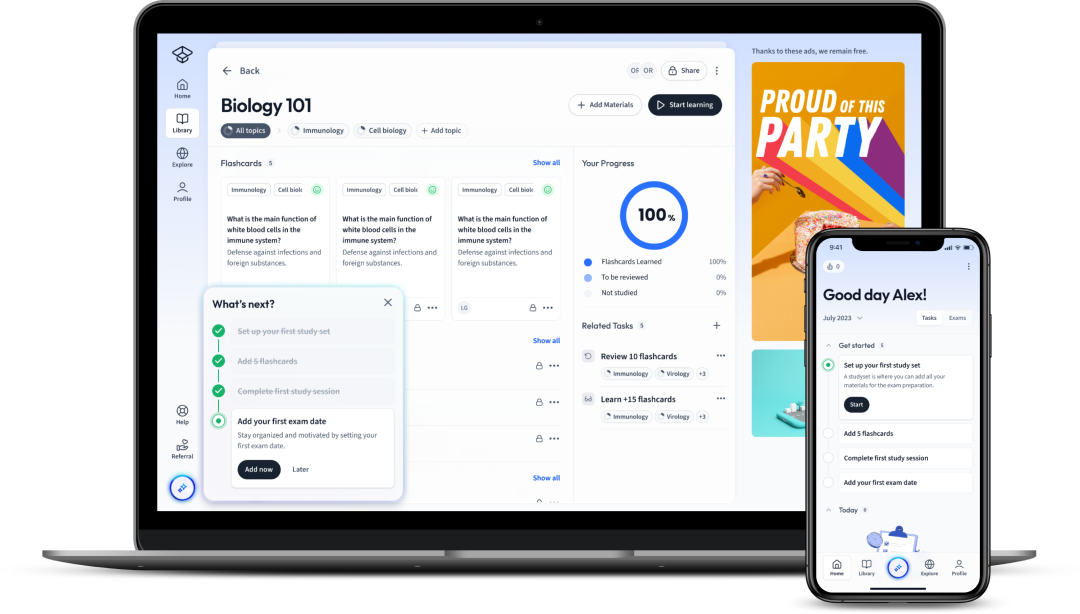

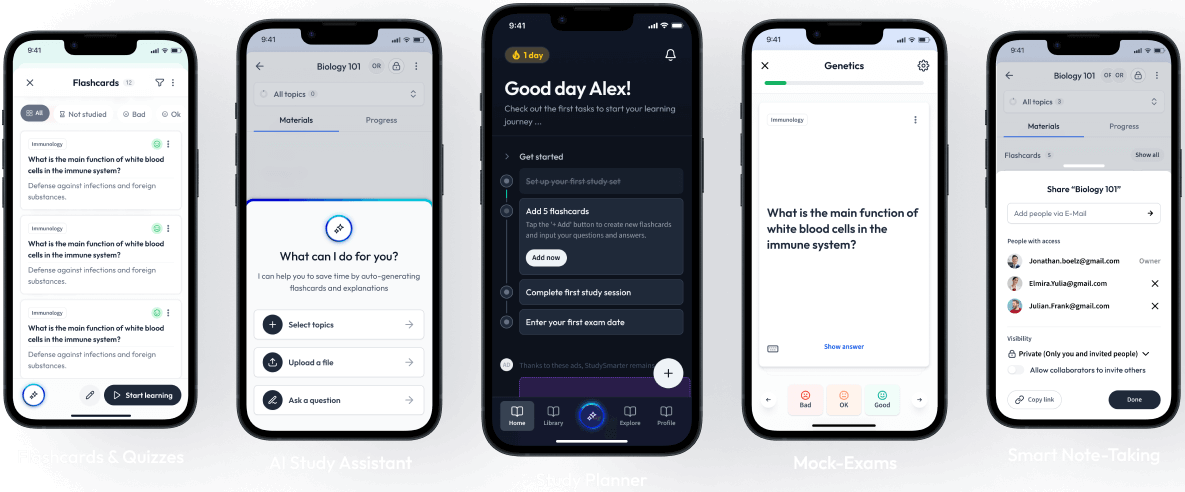

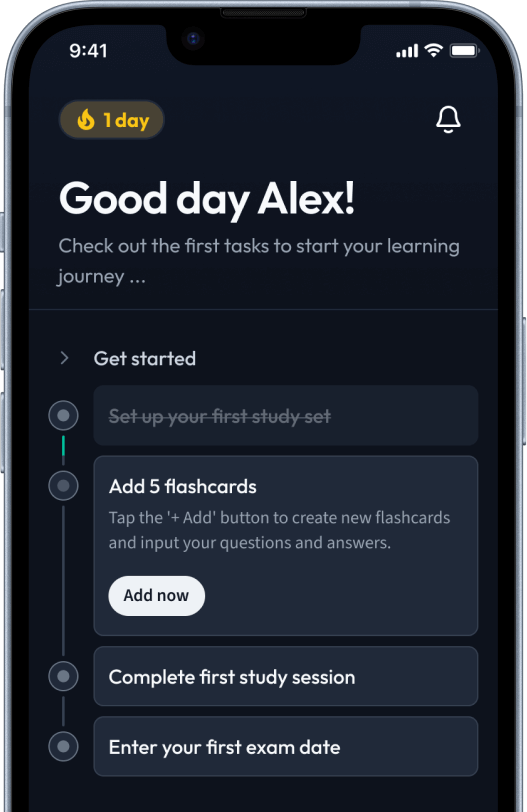

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Delve into the complex world of Corporate Finance, an integral component of Business Studies. This comprehensive overview provides an insightful analysis of its meaning and significance in business activities. From the essential elements and principles to applicational examples, every aspect of Corporate Finance is scrutinised. Beyond theory, its impact on restructuring practices and its relation with Investment Banking are also evaluated. The article concludes with an exploration of effective management strategies, equipping you with the knowledge to navigate the challenges and implement best practices within the domain of Corporate Finance.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDelve into the complex world of Corporate Finance, an integral component of Business Studies. This comprehensive overview provides an insightful analysis of its meaning and significance in business activities. From the essential elements and principles to applicational examples, every aspect of Corporate Finance is scrutinised. Beyond theory, its impact on restructuring practices and its relation with Investment Banking are also evaluated. The article concludes with an exploration of effective management strategies, equipping you with the knowledge to navigate the challenges and implement best practices within the domain of Corporate Finance.

Corporate Finance is a term you might have come across in your Business Studies, and it is indeed a vital aspect of business operations. In essence, it refers to the financial activities related to running a corporation. It encompasses various domains making it a vast and complex field. However, with a step-by-step breakdown, it's quite intriguing to follow.

Understanding corporate finance begins with decoding its meaning. In the simplest terms, it refers to decisions on investments, financing, and dividend policies a company makes to maximise the value for its shareholders or owners. Every decision made within an organisation has financial implications, and corporate finance aims to manage these effectively for the best possible outcomes.

Corporate finance is the field of finance that deals with how corporations address investment, financing, and dividend payout decisions with an aim to maximize shareholder value.

It includes plans on acquiring and using funds and, importantly, the strategy to compensate investors. There is a lot of Maths and Science involved in making these decisions, but let's not get into that right away. Breaking down the Corporate Finance meaning further, there are two main aspects:

Corporate finance has several important components, all of which contribute to its main aim- maximising shareholders' value. Here are the key components:

These components comprise the essential aspects of a company's financial planning and influence both its short-term and long-term strategies.

| Investment Decisions | These include critical decisions on where to invest the company's funds, such as putting money in new projects or purchasing assets. |

| Financing Decisions | These involve choices on sourcing funds. For instance, it could be from equity (shares), debts (loans), or retained earnings. |

| Dividend Policy | This is about deciding how and when to return money to the shareholders. It's a delicate balancing act as it involves keeping shareholders happy while ensuring sufficient funds for the business. |

Without finance, a business wouldn't run, hence the critical role of corporate finance in business activities. It navigates through the financial challenges, plans for growth, and ensures sustainable profitability. Here are a few specific roles it plays:

With the formula for NPV: \[ NPV = \sum \frac{{R_t}}{{(1+r)^t}} - C_0 \] where \(R_t\) is the net cash inflow during the period t, r is the rate of return, and \(C_0\) is the capital outlay at the beginning.

Consider a project costing $10,000 with an expected annual return of $2,000 for the next ten years. If the rate of return or discount rate is 5%, you can calculate the NPV and use it to decide whether to invest or not.

Corporate finance is omnipresent in the business world and offers invaluable insights into how organisations operate financially. With this understanding, let's now look at some real-world examples and applications.

Corporate finance is not some etheral concept sitting on the pages of a textbook. Instead, it's a vital tool that organisations utilise every day. Here are a couple of examples showcasing corporate finance in action:

Corporate finance plays an integral role in influencing strategic business decisions, both at the operational and strategic levels. Its impacts range from investment appraisals to risk management. Here's how:

Corporate finance is relevant for businesses of all sizes. However, the approach and components may differ between small businesses and large corporations.

Small businesses, especially start-ups, focus heavily on their cash flow management and raising capital. They are more likely to rely on sources like personal savings, loans from family and friends, crowd funding, or angel investment. Decisions in small businesses often revolve around maintaining liquidity and ensuring sustainability of operations.

On the other hand, in large corporations, corporate finance operates on a more complex level. Capital structuring often involves equity financing (like shares or retained earnings) and debt financing (like bonds or loans). Large corporations also have a formal finance department handling investment decisions, risk management, financial reporting, and more. Moreover, large corporations are often involved in activities such as mergers and acquisitions, which involve intricate corporate finance analysis.

| Small Businesses | Large Corporations | |

| Focus | Cash flow management, raising capital | Capital structuring, risk management, MA |

| Funding Sources | Personal savings, loans, crowd funding | Equity financing, debt financing |

| Decision making | Focused on liquidity and sustainability | Long term strategic planning, Risk-adjusted evaluation of alternatives |

Embarking on a journey to comprehend corporate finance necessitates becoming familiar with its core principles, understanding the correlation between risk and return, and exploring the impact of financial decisions on corporate value. These elements not only lay the foundation for corporate finance but also serve as guides in the decision-making process within a corporation.

Corporate finance operates around certain principles and concepts that are fundamental in organising financial resources and planning for a corporation's future. These principles guide financial decision-making and offer a roadmap for navigating financial risks and opportunities.

To optimise the firm's value, these principles should be applied in a risk-averse manner, considering both the return and risk of decisions. For instance, the Net Present Value (NPV) method used in investment decisions takes into account both the return and risk of a project by discounting the expected cash flows against the project's cost.

Risk and return are two fundamental components in corporate finance and there exists a crucial relationship between the two. The basic idea is this- the higher the risk associated with an investment or a financial decision, the higher the expected return, and vice versa.

Two key concepts illustrating this relationship are:

The Capital Asset Pricing Model (CAPM) is used to understand the risk-return trade-off quantitatively. The formula of CAPM is (\(R_i\) represents the expected return on capital, \(R_f\) is the risk-free rate, \(β_i\) is the sensitivity of the expected excess asset returns to the expected excess market returns, and \(R_m\) stands for expected return of the market):

\[ R_i = R_f + ß_i (R_m - R_f). \]This equation shows that the expected return on an asset or a financial decision is equal to the risk-free rate of return plus the asset's systematic risk level (β) multiplied by the market risk premium.

Every financial decision taken within an organisation has the potential to impact corporate value. Whether it's an investment decision, a financing decision or a dividend payout decision, all can directly alter a company's value in the market. Ultimately, all these financial decisions should work towards maximising shareholder value, which is the net present value of the expected future cash flows to the shareholders.

For example, good investment decisions, i.e., investing in positive NPV projects, can increase a company's future cash flows and, therefore, its market value. On the other hand, poor investment decisions, such as investing in negative NPV projects, can reduce a company's future cash flows and, consequently, its market value.

Similarly, a company's financing decisions, like how much money to raise through equity or debt, can also directly affect its value. An optimal capital structure that minimises the cost of capital can increase the company's market value. On the contrary, higher costs of capital, through increased interest payments or equity dilution, can decrease the company's market value.

The goal is to balance between risk and return in all financial decisions to ensure value maximisation. Since risk and return are correlated, managers need to find the optimal point where the company's value is maximised while keeping risk at an acceptable level.

Business restructuring and corporate finance go hand in hand. The strategic redesigning of a company's operations or financial structure tends to have tremendous financial implications. Therefore, corporate finance, with its focus on optimising shareholder value, plays a fundamental role in steering the course of a business restructuring process.

Corporate finance's role in business restructuring is multifaceted, considering the various aspects of corporate finance - from investment decisions and financing decisions to risk management. Decisions about financial resource allocation, capital structure modifications, asset divestiture or acquisitions all fall under the umbrella of corporate finance, making these experts important stakeholders in any restructuring endeavour.

Primarily, corporate finance teams are engaged in liquidity management. This aspect includes maintaining sufficient cash flows to meet the ongoing operational expenses and to service any debt. Since restructuring often arises out of financial distress, managing cash flows and ensuring the company's survival becomes central to the restructuring process.

Secondly, corporate finance experts play a significant role in deciding the financing mix. They analyse the company's current financial structure, assess the capital costs, and figure out a capital structure that minimises the cost of capital while ensuring that the company remains solvent in the short and long-term. This restructuring of the capital structure can involve retiring old debt, issuing new debt or equity, or a combination of these.

Lastly, divestitures or acquisitions are common happenings in business restructuring and corporate finance plays a crucial role in such decisions, often referred to as real assets decisions. The primary goal here is to identify non-core or non-performing assets and deciding whether to sell, spin-off, or liquidate.

For example, a company facing liquidity problems might need to sell off some assets to raise cash. Alternatively, a company facing declining profitability might need to acquire new assets or businesses to diversify its revenue streams. Such crucial decisions often call for involvement from corporate finance professionals.

In business restructuring, several change processes occur, which are significantly influenced by corporate finance. Let's take a closer look at some of these:

It is noteworthy to mention that corporate finance also plays a role in facilitating change management. For instance, when executing operational changes, it's essential to keep stakeholders informed about the company's financial standing. Good financial reporting assures stakeholders and can make the process of change smoother.

Looking through the lens of corporate finance, business restructuring can be perceived as strategic financial decision making designed to maximise shareholder value and ensure corporate survival.

From this perspective, several restructuring practices are influenced by corporate finance principles:

It is clear that business restructuring is not a simple process but a strategic manoeuvre involving complex financial decisions, and corporate finance plays a pivotal role in guiding these decisions and driving the restructuring process. It is essential for business leaders and corporate finance professionals alike to understand the financial implications of restructuring and how to maximally create shareholder value during the process.

Understanding the nuances between corporate finance and investment banking can be foundational if you're considering a career in the financial industry. Both fields are intertwined to some extent but serve different purposes and require distinct skills.

Before delving into a detailed comparison of corporate finance versus investment banking, it's essential to get clear on what each term entails.

Corporate Finance concerns itself with the monetary decisions that companies make and the tools and analyses used to make these decisions. It deals with capital structure, management of internal funds, budgeting, and resource allocation.

On the other hand, Investment Banking pertains to financial organisations known as investment banks that help other corporations, governments, and other entities raise financial capital by underwriting or acting as the client's agent in issuing securities. They also assist organisations involved in mergers and acquisitions (M&A).

From the definitions, it's evident that corporate finance largely involves an internal focus dealing with internal financial matters, while investment banking is externally focused, handling situations between corporations or between a corporation and the general market.

| Corporate Finance | Investment Banking |

| Internally Focused | Externally Focused |

| Works off Company's records | Deals with market-based transactions |

| Handles internal funds, budgeting and resource allocation | Assists companies in raising financial capital |

Roles and responsibilities in the two fields differ greatly, beginning with the nature and focus of the tasks.

In Corporate Finance, professionals deal with optimising the firm's financial resources, planning and budgeting, investment decisions, and balancing risk and profitability. Key responsibilities include:

In contrast, professionals in Investment Banking often play the role of financial advisors to corporations and governments, assisting in various transactions. Key responsibilities include:

If finance is your career pathway, deciding between corporate finance and investment banking can depend on your interests and strengths.

Careers in Corporate Finance:

Jobs in corporate finance offer a more stable work-life balance compared to investment banking. This field can lead to various roles, including financial analyst, cash management, credit manager, and more. The career path often begins with being a financial analyst and progressing to become the Chief Financial Officer (CFO).

Careers in Investment Banking:

On the other hand, Investment banking tends to be more dynamic with faster-paced work and deals with larger sums of money. It is competitive and often requires long working hours. The primary career path often starts as an analyst or associate, moving up to vice president, director, and eventually to a managing director position.

While corporate finance generally deals with day-to-day financial operations within a company, such as budget maintenance and variance analysis, investment banking focuses on large financial transactions, including mergers, acquisitions and capital raising activities.

Remember, the choice between corporate finance and investment banking isn't about which is better; it's about aligning your personal interests, lifestyle preferences, and career goals with the distinct roles and responsibilities each field offers.

In the fascinating yet intricate world of Corporate Finance, successful and efficient management is a crucial aspect. It involves taking financially beneficial decisions, optimally managing the firm's resources, handling investments and budgeting, and weighing risks against profitability.

To navigate the world of corporate finance effectively and make informed decisions, it is essential to develop and follow key strategic factors. Below are critical strategies imperative for proficient corporate finance management.

Cash Management: An efficient cash management system ensures a company has sufficient cash to meet its short-term obligations. Proactive management of accounts receivable and payable, inventory, and marketable securities aids in cash optimisation.

Capital Budgeting: Investment decisions relating to long-term projects are made through capital budgeting, often utilising tools like Net Present Value (NPV) and Internal Rate of Return (IRR). It is crucial as substantial resources are tied in such decisions, and they can have lasting effects on a company's financial performance. The formula for calculating NPV in LaTeX: \[ NPV = \sum \frac{R_t}{(1+i)^{t}} - C \]

Risk Management: The ability to identify, assess, and manage financial risks is a significant aspect of corporate finance management. Companies need to balance between risk and return, keeping an eye on the market dynamics and maintaining a diverse investment portfolio.

Long-Term Financing: Companies need to develop strategies for raising long-term finances, either through equity (stock issuance) or debt (loans or bonds).

The world of corporate finance is not devoid of challenges. These hurdles can arise due to inconsistencies in internal processes, volatile market conditions, or external factors such as regulations and financial crises.

Adopting best practices in corporate finance management can provide a company with a competitive edge, increase profitability, and enable sustainable growth. Following are some of the best practices in this regard.

Implementing Robust Financial Controls: It is crucial to have strong internal control systems to ensure accurate reporting, adherence to regulations, and prevention of fraud.

Strategic Planning: Corporations that incorporate financial planning and analysis (FP&A) into their strategic decision-making tend to be more successful. This involves the use of predictive analytics, statistical modelling, and scenario analysis to forecast future financial trends.

Flashcards in Corporate Finance4749

Start learningWhat is corporate finance and what are its two main aspects?

Corporate finance refers to decisions on investments, financing, and dividend policies made by a company to maximise the value for its shareholders or owners. Its two main aspects are financial decision making, which includes managing cash flow and risks, and capital funding, which involves obtaining funds through equity or debt.

What are the main components and roles of corporate finance in businesses?

The main components of corporate finance are investment decisions, financing decisions, and dividend policy. Its key roles in businesses include investment appraisal, funding, risk management, and asset or company valuation.

What are some real-world examples of corporate finance in operation?

Some examples of corporate finance in operation include Apple's decision to invest in the iPhone, Facebook's acquisition of WhatsApp, and Alibaba’s fundraising through an Initial Public Offering. These decisions were shaped by corporate finance tools like Net Present Value (NPV), Internal Rate of Return (IRR) and capital structuring.

How does corporate finance differ between small businesses and large corporations?

Small businesses focus on cash flow management and raising capital, often from personal savings or loans. Decisions tend to revolve around maintaining liquidity and operational sustainability. Large corporations, on the other hand, undertake complex capital structuring involving equity and debt financing. They make strategic long-term decisions, manage risks, and engage in activities like mergers and acquisitions.

What are the core principles of corporate finance?

The core principles of corporate finance are the investment principle, which is about making investments that yield the highest return for the lowest risk, the financing principle, which involves choosing a financing mix that maximises the value of investments, and the dividend principle, which stresses the importance of managing dividends or return contributions to shareholders.

What is the relationship between risk and return in corporate finance?

In corporate finance, the higher the risk associated with an investment or financial decision, the higher the expected return, and vice versa. Systematic risk and unsystematic risk illustrate this relationship. The Capital Asset Pricing Model (CAPM) is used to understand the risk-return trade-off quantitatively.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in